5 Things To Do Immediately After a Car Accident

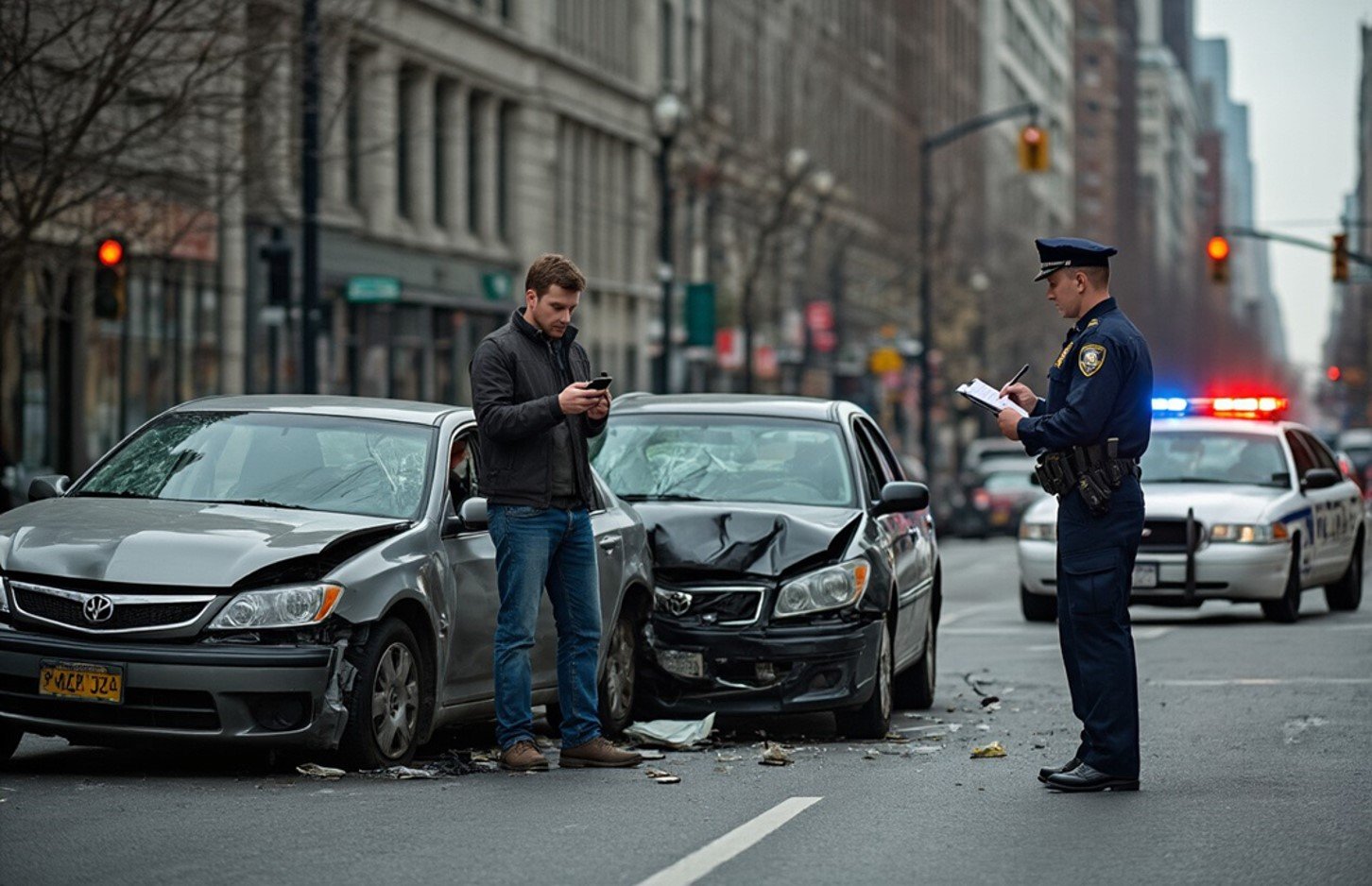

Getting into a car accident can leave you shaken and unsure what to do next. The moments right after a crash are critical—both for your safety and for protecting yourself legally and financially. Knowing the right steps can make the difference between a smooth insurance process and costly complications later.

This guide walks you through five essential actions: how to stay safe, secure the scene, deal with authorities, document everything properly, and file your insurance claim without delays.

STEP 1: Stay Calm and Prioritize Safety

The first few minutes after a collision are often chaotic. Your ability to stay calm will help you think clearly and avoid mistakes.

Begin with yourself and your passengers. Take a slow, careful check of your body for pain or injuries, remembering that shock can mask symptoms. Ask your passengers how they feel and encourage them to be honest about any discomfort. Even if no one seems hurt, keep in mind that some injuries—like whiplash—can appear hours later.

Once you know your car is safe to exit, look toward the other driver and their passengers. Check from a distance at first. If everyone appears stable, you can approach cautiously. Showing concern for others can help reduce tension and create a cooperative atmosphere.

Above all, maintain composure. Anger or panic won’t help. A calm attitude gives you more control and reassures those around you that the situation is being handled responsibly.

STEP 2: Secure the Accident Scene

After ensuring no one is in immediate danger, focus on preventing a second accident.

If your vehicle is still drivable, move it out of the traffic lane to the shoulder or a nearby safe spot. Do this carefully and slowly, watching for any fluid leaks, smoke, or unusual sounds. If something feels unsafe, stop immediately once you’re clear of traffic.

Switch on your hazard lights so oncoming vehicles know to slow down. If you have road flares, place them a good distance behind the vehicles to give drivers more warning. These simple actions can stop a minor accident from turning into something much worse.

STEP 3: Contact Authorities and Document the Scene

No matter how minor the accident seems, call 911. Reporting the accident ensures there is an official record, which both you and your insurance company will rely on. Tell the dispatcher your exact location, what happened, and whether anyone needs medical help.

When police officers arrive, provide them with clear, factual details of what you saw and experienced. Avoid speculating about fault or making guesses—stick to what you know.

It’s also smart to ask for the officers’ names and badge numbers and to request a copy of the police report once it’s available. This document will carry significant weight during your insurance claim.

Helpful Details to Record

| Information | Purpose |

| Officer names and badge numbers | For reference later |

| Police report number | Required for insurance |

| Time and location | Establishes facts clearly |

STEP 4: Exchange Information and Gather Evidence

Once the authorities have been contacted, your next step is to gather all necessary information from the scene.

Exchange details with the other driver: full name, phone number, address, and insurance information. Do the same for your own records. Also note the make, model, color, and license plate number of all vehicles involved.

Take photographs of the damage from several angles. Don’t just focus on your own car—include the other vehicles, skid marks, road signs, and any surrounding conditions. These images provide evidence that may later protect you in case of disputes.

If there are witnesses nearby, ask politely if they’re willing to share their contact details. A neutral statement from someone who saw the accident can be very helpful.

STEP 5: File Your Insurance Claim Promptly

The final step is to notify your insurance company as soon as possible. Even if you believe the other driver was at fault, your policy usually requires immediate reporting. Delays could create unnecessary complications.

When you call, be prepared to share the basics: when and where the accident occurred, who was involved, and a short description of what happened. Your photographs and the police report will serve as strong supporting evidence.

After you file the claim, an insurance representative will guide you through the process. They may arrange an inspection, request documents, and communicate with the other party’s insurer. Staying responsive will help speed up the process and ensure you get the coverage you’re entitled to.

Final Thoughts

Car accidents are stressful, but having a clear plan helps. By staying calm, securing the scene, involving authorities, documenting everything, and filing your claim promptly, you protect both your safety and your legal interests.

Whether it’s a small fender bender or a more serious collision, these five steps provide a steady framework to follow—so you can move forward with confidence instead of confusion.

Need Help Now?

Accidents can happen anytime, anywhere—and when they do, you don’t have to face them alone.

Call Dreamliner Road Rescue at (204) 963-8913

We’re available 24/7 for tire repair, replacement, and towing. Our team will get you safely back on the road with fast, reliable service.